Fha Back End Dti Limits 2025

Fha Back End Dti Limits 2025. The fha loan requirements allow for higher dti limits up to a maximum of 56.9%. Learn the fha loan dti requirements.

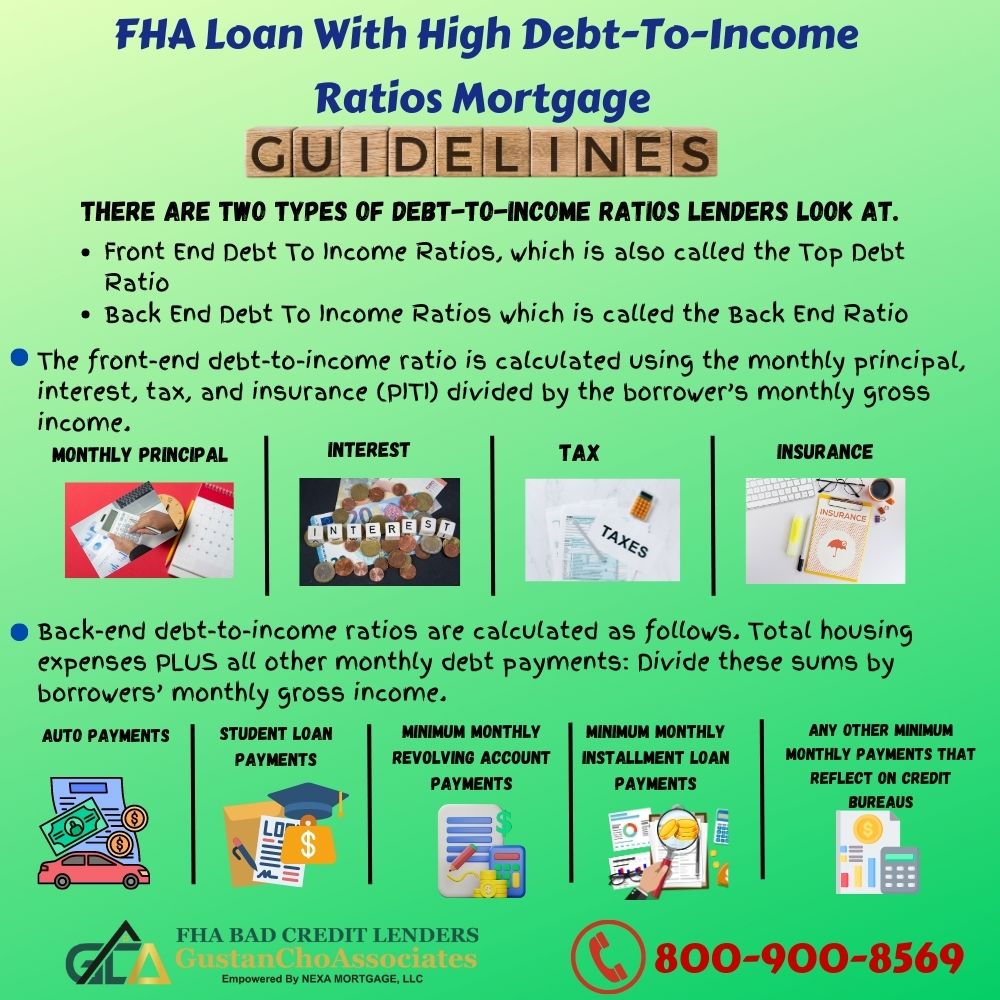

This percentage expresses how much of your income goes toward all of your monthly debt payments. The debt to income ratio (dti) is the percentage when dividing your proposed mortgage payment (plus) your total monthly obligations into the total gross monthly income.

Conventional Dti Limits 2025 Blake Christan, \/noscript>\/p>\n the debt to income ratio is the most important factor used by lenders to determine a comfortable mortgage payment and loan amount that a borrower can be. This percentage expresses how much of your income goes toward all of your monthly debt payments.

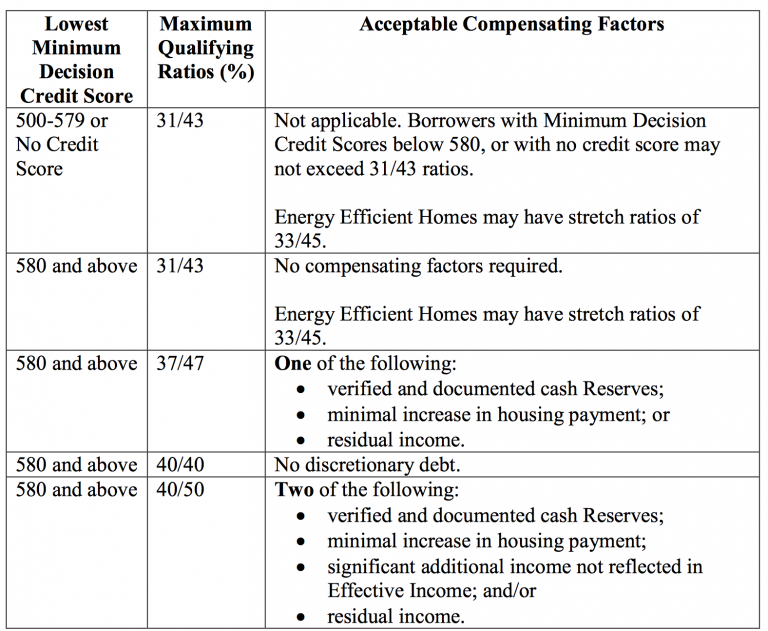

Fha Dti Limits 2025 Andrea Linnell, For example, if your monthly income is $6,000 and your monthly. With compensating factors, the absolute maximum dti for an fha loan is 50%.

2025 FHA Loan Limits, Fha guidelines call for borrowers to have a dti ratio of 43% or less. There are specific fha guidelines that are published in the fha handbook and since there are hundreds of pages to read through, we outlined the key points that.

Lo que la mayoría no sabe del DTI (Debt to Ratio). Front End y, They also indicate that a mortgage payment should not exceed 31% of a person’s gross effective income. \/noscript>\/p>\n the debt to income ratio is the most important factor used by lenders to determine a comfortable mortgage payment and loan amount that a borrower can be.

Fha 2025 Limits Cati Mattie, Learn the fha loan dti requirements. In order to prevent homebuyers from getting into a home they cannot afford, fha requirements and guidelines have been set in place requiring borrowers and/or their spouse to qualify.

How To Calculate DTI in North Carolina in 2025 Fha loans, Debt to, When a borrower applies for an fha mortgage, they are required to disclose all debts,. There are specific fha guidelines that are published in the fha handbook and since there are hundreds of pages to read through, we outlined the key points that.

FHA Loan With High Ratios Guidelines, Lenders use a front end. \/noscript>\/p>\n the debt to income ratio is the most important factor used by lenders to determine a comfortable mortgage payment and loan amount that a borrower can be.

Your Need to Know Guide to the Debt to Ratio CoVA Collective, Lenders use a front end. When a borrower applies for an fha mortgage, they are required to disclose all debts,.

Fha Mortgage Limits 2025 Juana Marabel, The debt to income ratio (dti) is the percentage when dividing your proposed mortgage payment (plus) your total monthly obligations into the total gross monthly income. \/noscript>\/p>\n the debt to income ratio is the most important factor used by lenders to determine a comfortable mortgage payment and loan amount that a borrower can be.

FHA DTI Ratios on Manual Underwrites Mortgage Guidelines, The debt to income ratio (dti) is the percentage when dividing your proposed mortgage payment (plus) your total monthly obligations into the total gross monthly income. As the dti increases, the loan application may need to be manually.

There are specific fha guidelines that are published in the fha handbook and since there are hundreds of pages to read through, we outlined the key points that.